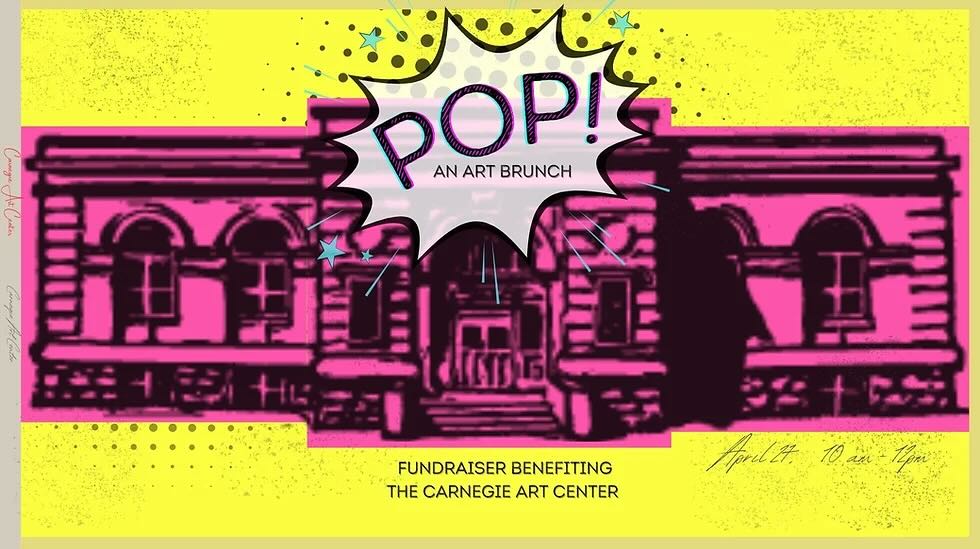

Pop! An Art Brunch to benefit the Carnegie Art Center

Carnegie Art Center 120 S Broad Street, Mankato, MN, United StatesJoin us for a social style brunch on Saturday, April 27th, from 10am – 12pm at the Carnegie Art Center! The Carnegie Art Center is hosting its first fundraising event, a vibrant Pop Art themed brunch, including delectable food, artful themed drinks, live art demonstrations,...